The West dominates the top 10 rankings of the most innovative economies as measured by the Global Innovation Index, including Switzerland, the United States, Sweden, the United Kingdom, the Netherlands, Germany, Finland, and Denmark. We would expect that innovative crypto projects would continue to originate from these locations. Author: James Rubin Source link

Tag: Market

Bitcoin Market Impact From Mt. Gox Repayments Will Be Limited: Matrixport

Not all the stolen bitcoin was recovered, so only a fraction of the original amount held by creditors will be compensated, the report said. Author: Will Canny Source link

New ‘Pepe the Frog’ Crypto Token Becomes Sixth Largest Meme Coin by Market Cap – Altcoins Bitcoin News

A new token named after Pepe the Frog, the infamous meme, and cartoon character created by Matt Furie, has entered the meme coin economy. The token is called pepe (PEPE), and at the time of writing, it has become the sixth-largest meme coin asset in terms of market capitalization, valued at just over $130 million. However, amidst the fast rise, both the website coinmarketcap.com and the Web3 security startup Gopluslabs have warned that the contract owner may have the ability to modify the transaction tax and blacklist function. PEPE Market…

Top 7 legal and compliance jobs in the crypto market

Cryptocurrencies are a rapidly growing market that is changing how people invest, buy and sell goods and services, and transfer money. However, with the growth of this market comes an increasing need for legal and regulatory compliance, particularly concerning issues such as money laundering, fraud and data protection. As a result, there is a demand in the cryptocurrency sector for legal and compliance specialists. The positions listed below are just a few examples of the various legal and compliance positions available in the cryptocurrency sector. Each one is crucial to…

Stablecoin Market Sees Fluctuations With Some Coins Gaining and Others Reducing Supply – Altcoins Bitcoin News

According to statistics, on March 26, the stablecoin economy was valued at $135 billion, with the top stablecoins representing $31.8 billion or 75% of the $42.17 billion in 24-hour global trade volume across the entire crypto market. In the last two weeks since March 11, 7.06 billion USDC and 351.57 million BUSD have been redeemed. Meanwhile, from March 14 to March 26, the number of tether stablecoins in circulation increased by 6.12 billion. Stablecoin Circulation Changes In recent weeks, the supplies of some stablecoins have decreased while others have increased.…

$920B is the number to watch now that crypto’s trillion dollar total market cap is gone

Big round numbers always pique the interest of investors and the $1 trillion total crypto market capitalization is no exception. It’s a level that held for 48 days before collapsing on March 9. After a 16-hour negative 8.6% price movement, the indicator fell to $914 billion, its lowest level since Jan.13. Total crypto market cap in USD, 1-day. Source: TradingView Concerns about the stability of the U.S. banking industry, specifically the downfall and subsequent closure of Silvergate Bank (SI) on March 8 and the shut down of Silicon Valley Bank…

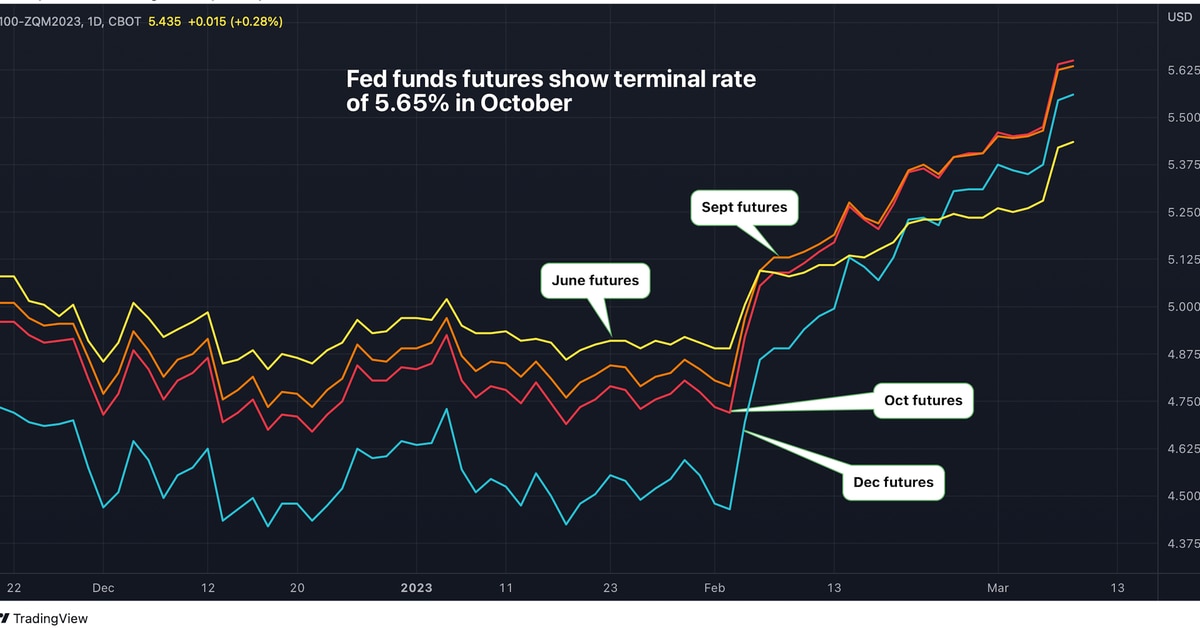

Bitcoin Slips to 3-Week Low as Market Sees Federal Reserve Lifting Rates to 5.65%

If that’s not enough, the market now sees a 70% probability of the Fed raising rates by 50 basis points later this month, a reacceleration of tightening after a brief step down 25 bps in February. The yield on the two-year Treasury note, which is sensitive to interest rate expectations, has crossed above 5% for the first time since 2007 and could rise further toward 5.655, considering the terminal rate pricing. Author: Omkar Godbole Source link

Ebb and Flow of Stablecoin Economy Continues With BUSD’s Market Cap Dropping Below $10 Billion Range – Altcoins Bitcoin News

The realm of stablecoins is an ever-evolving landscape and the number of coins in circulation for the stablecoin BUSD has fallen below the 10 billion mark to approximately 9.68 billion on March 3, 2023. Over the last 30 days, BUSD’s token supply has dropped 40% lower. In contrast, the number of tethers in circulation has increased by 4.7% to 71.11 billion in the last month. BUSD Slips Below $10 Billion, Tether Supply Rises by 4.7% to Over $71 Billion In the stablecoin economy, currency supply fluctuations are key drivers of…

Artificial Intelligence Crypto Assets Continue to Surge, Accounting for $4 Billion in Market Value – Altcoins Bitcoin News

Following a brief downturn in mid-February 2023, artificial intelligence (AI) crypto assets have continued to see gains over the last 30 days. Currently, out of 74 listed AI-focused cryptocurrencies, the net value of all these tokens has risen to more than $4 billion, which accounts for 0.37% of the entire crypto economy’s value. Majority of Listed AI Cryptocurrencies See Positive Gains Over Last Month Artificial intelligence (AI) has been a dominant theme in 2023, resulting in a significant surge in the value of AI-focused tokens this year. Bitcoin.com News reported…

Nearly 3 Billion BUSD Stablecoins Have Been Removed From the Market in 6 Days – Altcoins Bitcoin News

Six days ago, a few hours before the blockchain infrastructure platform Paxos announced it would no longer mint BUSD stablecoins, $2.86 billion worth of BUSD were redeemed. Currently, Binance is the most active exchange trading BUSD tokens, and the stablecoin still commands roughly 10.7% of the crypto economy’s $67.71 billion in global trade volume over the past 24 hours. BUSD Supply Shrinks by 17.77% in 6 Days Statistics show that a significant amount of BUSD has been redeemed over the past six days, with the supply dropping by 17.77% during…