Andrew Hinkes, a partner at law firm K&L Gates, tweeted that the bill was “destined to fail” because it misunderstood crypto. It won’t be possible to apply the provisions to decentralized organizations, and the market doesn’t exist to offer the kind of auditing or insurances James is proposing, Hinkes said. Author: Jack Schickler Source link

Tag: Crypto

Kenya considers tax on crypto, NFT transfers and online influencers

Kenya’s lawmakers are considering the introduction of a 3% tax on cryptocurrency and nonfungible token (NFT) transfers and a 15% tax on monetized online content, according to a newly introduced bill. Introduced to the Kenyan parliament on May 4, The Finance Bill, 2023 would enact a digital asset tax on “income derived from the transfer or exchange of digital assets” which also included specific language for NFTs. The bill will undergo five rounds of readings, committees and reports by the National Assembly, if passed, it will then be passed to…

Dubai Fintech Summit Welcomes Crypto Oasis as Web3 Ecosystem … – Digital Journal

Dubai Fintech Summit Welcomes Crypto Oasis as Web3 Ecosystem … Digital Journal Author: Source link

Crypto Exchange Coinbase to Stop Issuing New Loans Via Coinbase Borrow

“We regularly evaluate our products to ensure we’re prioritizing the offerings that our customers care about most,” the spokesperson said. “Effective May 10, we will stop issuing new loans through Coinbase Borrow. There is no impact on customers’ outstanding loans, and no action is required from them at this time.” Author: Cheyenne Ligon, Nikhilesh De Source link

Bitcoin (BTC) and Ether (ETH) Could Face Risks From Potential Short Squeeze in Dollar Index; Crypto Options Trader QCP Capital

However, the good times may stop rolling if the heavily shorted U.S. dollar, which has recently found a “double bottom” price floor against major fiat currencies, sees a short squeeze – a rally powered by an unwinding of bearish bets, as per Singapore-based options trading firm QCP Capital. Author: Omkar Godbole Source link

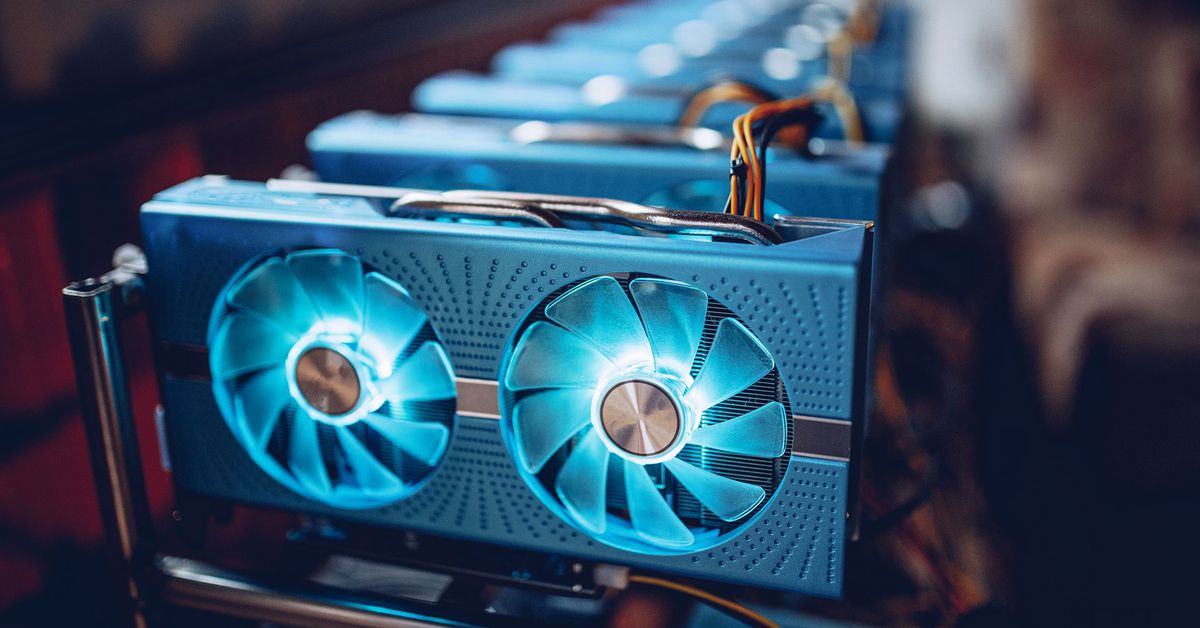

Riot Platforms (RIOT), Marathon Digital (MARA) Could Face Hefty U.S. Crypto Mining Tax

“Currently, cryptomining firms do not have to pay for the full cost they impose on others, in the form of local environmental pollution, higher energy prices, and the impacts of increased greenhouse gas emissions on the climate,” according to the CEA’s description of the levy known as the Digital Asset Mining Energy tax. Author: Jesse Hamilton Source link

Mastercard launches Mastercard Crypto Credential to boost trust in blockchain The Block

Mastercard has introduced Mastercard Crypto Credential, a set of common standards and infrastructure that will help verify interactions among consumers and businesses using blockchain networks. Mastercard Crypto Credential aims to provide a foundation for financial institutions, governments, brands, and crypto players, ensuring that those interested in interacting across web3 environments are meeting defined standards for the types of activities they’d like to pursue. Raj Dhamodharan, executive VP, Blockchain and Digital Currencies at Mastercard, said: “Setting up and scaling trusted ecosystems to enable commerce is not new to Mastercard. “We’ve done…

U.S. House Will Have Crypto Bill in 2 Months, Says Rep. Patrick McHenry

Sen. Cynthia Lummis (R-Wyo.), the other panellist during the session, said she looked forward to coordinating those efforts with McHenry, adding that the House had a better chance than the Senate at getting legislation through earlier. She said if the House moves first on crypto, it would “improve our chances” in the Senate. Author: Amitoj Singh Source link

The Crypto Miner Reckoning: No Fate but What We Make

As Bitcoin ages into its teens, it’s time to move beyond tribalism so we can work collectively with legislators and innovate business models of the future, writes Samir Tabar of Bit Digital. Author: Sam Tabar Source link

Tax law researchers propose IRS framework for deducting crypto losses

Researchers at Indiana University and the University of Maine recently published a study examining the current state of cryptocurrency tax law in the United States. The research concludes with recommendations for the Internal Revenue Service (IRS) that, if adopted, would prevent taxpayers from weighing crypto losses against other capital gains. The paper, dubbed simply “Crypto Losses,” seeks to define the various forms of loss that can be accrued by businesses and individuals invested in cryptocurrency and proposes a “new tax framework.” Current IRS guidelines concerning cryptocurrency are somewhat nebulous. For…