However, the good times may stop rolling if the heavily shorted U.S. dollar, which has recently found a “double bottom” price floor against major fiat currencies, sees a short squeeze – a rally powered by an unwinding of bearish bets, as per Singapore-based options trading firm QCP Capital. Author: Omkar Godbole Source link

Author: Omkar Godbole

Crypto Options Exchange Deribit Adding Zero-Fee Spot Trading

“With this latest addition, our platform now boasts a comprehensive suite of both derivatives and spot trading solutions, catering to the diverse needs of traders in the digital asset space,” Luuk Strijers, chief commercial officer at Deribit, told CoinDesk. Author: Omkar Godbole Source link

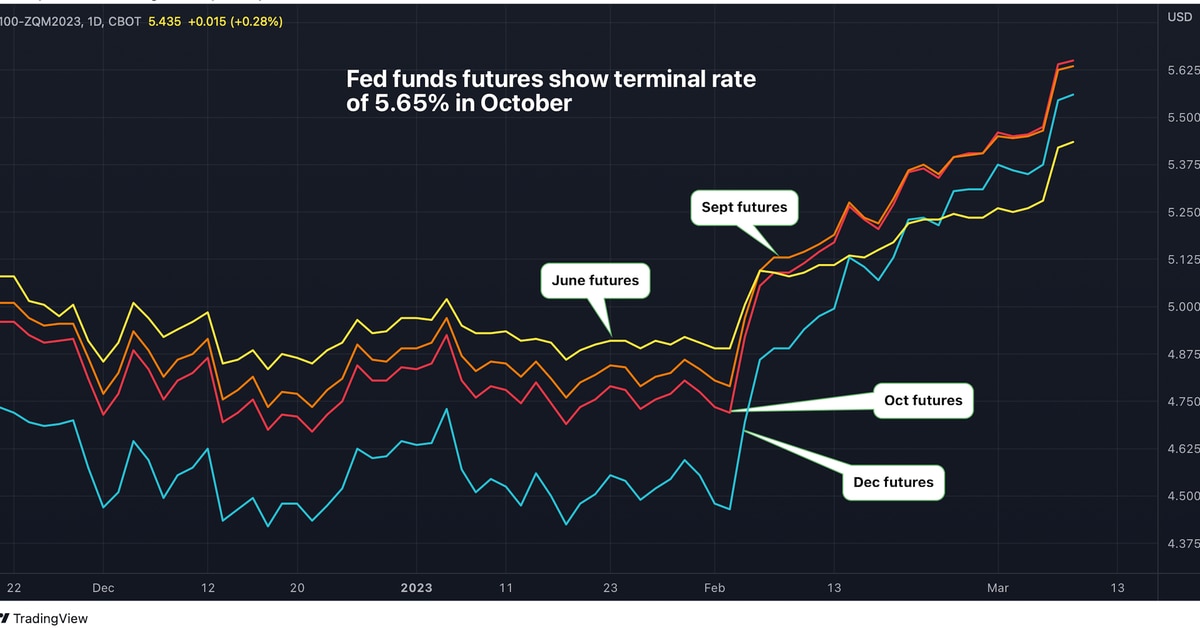

Bitcoin Slips to 3-Week Low as Market Sees Federal Reserve Lifting Rates to 5.65%

If that’s not enough, the market now sees a 70% probability of the Fed raising rates by 50 basis points later this month, a reacceleration of tightening after a brief step down 25 bps in February. The yield on the two-year Treasury note, which is sensitive to interest rate expectations, has crossed above 5% for the first time since 2007 and could rise further toward 5.655, considering the terminal rate pricing. Author: Omkar Godbole Source link

Bitcoin: es poco probable que registre una recuperación notable tras el short squeeze del jueves

Los rendimientos del Tesoro de Estados Unidos continúan siendo elevados luego de la publicación de los datos del CPI, algo que ofrecería una prueba de realidad para los activos de riesgo, incluyendo las criptomonedas. Author: Omkar Godbole Source link

Shares in Grayscale's Bitcoin Trust Trade at 36% Discount to Fund's NAV

The shares first slipped into discount in February 2021 primarily due to alternatives like ETFs becoming available in Canada and Europe. Author: Omkar Godbole Source link

Ether Tops $1.9K as Ethereum Runs Final ‘Merge’ Rehearsal

The native token of the Ethereum blockchain rose to $1,919, the highest since June 1, extending Monday’s rise of nearly 9%, CoinDesk data shows. The ether-bitcoin exchange rate or the ETH/BTC ratio rose to 0.078, a level last seen on Jan. 7, extending the recent bullish breakout. Author: Omkar Godbole Source link

Bitcoin’s Correlation With Gold-Backed PAXG Token Weakens to Record Low

“This reflects BTC’s increasing correlation with macro stock indices as well as its recent behavior as a risk asset rather than a store-of-value, and points to price turbulence ahead as markets digest the impact of further inflation and liquidity withdrawals,” Noelle Acheson, head of market insights at CoinDesk’s sister concern Genesis Global said. Author: Omkar Godbole Source link

First Mover Americas: The Bitcoin Death Cross

Stablecoins are tokens tracked by a blockchain, but in contrast to assets like bitcoin (BTC), they’re intended to consistently match the buying power of a fiat currency, most often the U.S. dollar. Stablecoins were first created to give active crypto traders a tool for moving quickly between more volatile positions, though as we’ll see, the potential for big interest rates on loans has also helped attract capital. Author: Omkar Godbole Source link

Bitcoin Falls to Six-Week Low Amid Risk-Off Sentiment

“I don’t remember this level of bearishness amongst contacts and Twitter, even back on cycle lows in January,” one fund manager said. Author: Omkar Godbole Source link

Traders de cripto ven atractivas las opciones de ether ante la caída de la ‘volatilidad implícita’

De hecho, los sesgos put-call, que miden el costo de las opciones put en relación con las opciones call, muestran que las opciones put obtienen un precio más alto que las opciones call en todos los períodos de tiempo, incluido el vencimiento de seis meses. Los comerciantes han estado comprando salidas en los últimos tiempos. “También hemos visto una gran demanda de puts de baja delta [menor ejercicio], particularmente en ETH, a lo largo de los vencimientos hasta diciembre, con picos tan bajos como 1.000. Esto también podría ser una…