While this was happening on Thursday, I was in downtown Atlanta at the Georgia World Congress Center at TABConf, a developer-focused Bitcoin conference. I was sitting in a workshop titled “Attacking Lightning,” parsing what was going on in the markets. Meanwhile, no one else in the room seemed to care. It’s unclear if they even knew the market was doing whatever it was doing. Author: George Kaloudis Source link

Tag: Stocks

Framework to ban members of Congress and SCOTUS from trading stocks includes crypto provision

Members of the United States House of Representatives and Senate as well as Supreme Court justices currently trading cryptocurrencies may have to stop HODLing while in office should a bill get enough votes. According to a framework released on Thursday, chair Zoe Lofgren of the Committee on House Administration — responsible for the day-to-day operations of the House — said she had a “meaningful and effective plan to combat financial conflicts of interest” in the U.S. Congress by restricting the financial activities of lawmakers and SCOTUS justices, as well as…

Bitcoin Hanging Tough as Stocks Slide

“Bitcoin continues to display strong resilience in the face of a broader risk-averse mood in financial markets,” Craig Erlam, senior market analyst at the foreign-exchange brokerage Oanda, wrote in an investor update. “Given it is the ultimate risk asset, this is quite surprising and perhaps even encouraging.” Author: Omkar Godbole, Bradley Keoun Source link

Bitcoin and Stocks Drop; Analysts See Risk of Further Downside

●Bitcoin (BTC): $20550, −2.06% ●Ether (ETH): $1084, −2.16% ●S&P 500 daily close: 3,674.84, +0.22% ●Gold: $1840 per troy ounce, −0.31% ●Ten-year Treasury yield daily close: 3.24% Bitcoin, ether and gold prices are taken at approximately 4pm New York time. Bitcoin is the CoinDesk Bitcoin Price Index (XBX); Ether is the CoinDesk Ether Price Index (ETX); Gold is the COMEX spot price. Information about CoinDesk Indices can be found at coindesk.com/indices. Author: Helene Braun, Bradley Keoun Source link

Crypto Carbon Trading Is Racing to Clean Up Its Act; Cryptos Drop Even as Stocks Rise

“Some traditional internet business models, like advertising, are likely to persist in the metaverse. However, with blockchain-adjacent technologies such as decentralized identity and zero-knowledge proofs (ZKP), one’s privacy can actually be preserved in the metaverse, if we construct the foundations just right. Nonetheless, leveraging these kinds of privacy and identity technologies, especially ZKPs, may come with the additional hurdle of poorer latency [because] the zero-knowledge proof itself can be computationally expensive to perform.” (CoinDesk columnist Daniel Kuhn) … “And yet, even if met with dogma or incredulity, innovation is rarely…

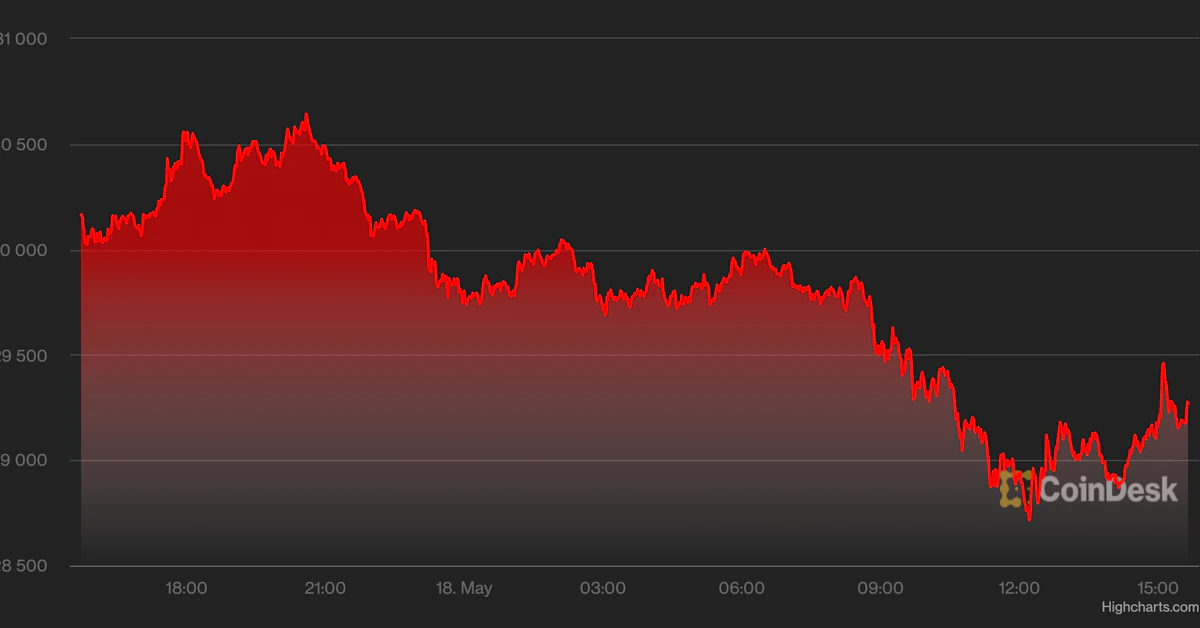

20% drop in the S&P 500 puts stocks in a bear market, Bitcoin and altcoins follow

Whoever coined the phrase “sell in May and go away” had brilliant insight and the performance of crypto and stock markets over the past three weeks has shown that the expression still rings true. May 20 has seen a pan selloff across all asset classes, leaving traders with few options to escape the carnage as inflation concerns and rising interest rates continue to dominate the headlines. Data from Cointelegraph Markets Pro and TradingView shows that the price of Bitcoin (BTC) taking on water below $29,000 and traders worry that losing…

Bitcoin and Stocks Dip as Volatility Spikes

The stock market declines came after retail and tech stocks underperformed on Wednesday. Also, the Chicago Board Options Exchange’s CBOE Volatility Index (VIX), a popular measure of the stock market’s expectation of volatility based on S&P 500 index options, ticked higher on Wednesday, reversing a week-long downtrend. Author: Damanick Dantes Source link

Market Wrap: Cryptos and Stocks Mixed Amid Bearish Sentiment

Bitcoin (BTC) is stabilizing around $30K while stock market volatility is fading. Altcoins were mixed, although recent underperformance could signal caution among some traders. Indicators show short-term BTC buying, albeit with limited upside. Author: Damanick Dantes Source link

$1.9T wipeout in crypto risks spilling over to stocks, bonds — stablecoin Tether in focus

The cryptocurrency market has lost $1.9 trillion six months after it soared to a record high. Interestingly, these losses are bigger than those witnessed during the 2007’s subprime mortgage market crisis — around $1.3 trillion, which has prompted fears that creaking crypto market risk will spill over across traditional markets, hurting stocks and bonds alike. Crypto market capitalization weekly chart. Source: TradingView Stablecoins not very stable A massive move lower from $69,000 in November 2021 to around $24,300 in May 2022 in Bitcoin’s (BTC) price has caused a selloff frenzy…

Crypto Related Stocks in Asia See Volatile Trading Amid Bitcoin Recovery

Traditional market investors risked off publicly traded companies related to the crypto sector amid a drop in prices this week. Author: Shaurya Malwa Source link