Dubai Fintech Summit Welcomes Crypto Oasis as Web3 Ecosystem … Digital Journal Author: Source link

Tag: Digital

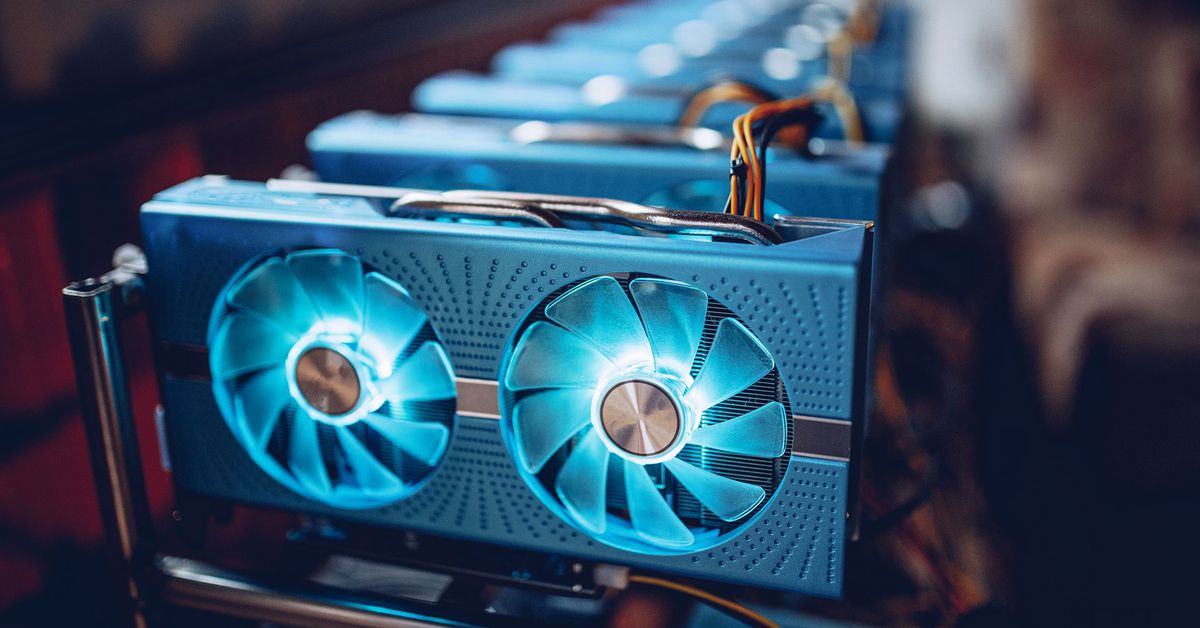

Riot Platforms (RIOT), Marathon Digital (MARA) Could Face Hefty U.S. Crypto Mining Tax

“Currently, cryptomining firms do not have to pay for the full cost they impose on others, in the form of local environmental pollution, higher energy prices, and the impacts of increased greenhouse gas emissions on the climate,” according to the CEA’s description of the levy known as the Digital Asset Mining Energy tax. Author: Jesse Hamilton Source link

California approves blockchain-based digital wallet for gov’t services

The county of Santa Cruz in northern California is one of the latest to adopt and implement the usage of blockchain-based solutions on a governmental level. In a meeting of the Board of Supervisors for the County of Santa Cruz held on April 25, the members unanimously decided to go forward with implementing the usage of digital wallets, for government services and official documentation purposes. According to the final consensus of the meeting, the white-label digital wallet powered by HUMBL will launch a 3-stage pilot program starting in July 2023.…

Bitcoin Miner Sphere 3D Sues Partner Gryphon Digital

The complaint, filed with the Southern District of New York on Friday, alleges Gryphon CEO Rob Chang wired 18 of Sphere 3D’s bitcoin to an address belonging to a fraudster who masqueraded as Sphere 3D’s chief financial officer in January, and another eight bitcoin to the same address a few days later. The lawsuit also alleges Gryphon provided “abhorrent” services to its partner and misrepresented Sphere 3D’s computing power as its own in public disclosures. Author: Eliza Gkritsi Source link

A spotlight on Binance, Galaxy Digital swings to profit, China’s blockchain push

Regulators in the United States have a fresh target on their radar: Binance. The Commodity Futures Trading Commission (CFTC) has sued the world’s biggest crypto exchange by trading volume for regulatory violations. Accusations range from insider trading to concealing office locations around the world to evade authorities’ oversight. Binance denies the claims, suggesting another court battle between crypto firms and U.S. regulators is just around the corner. On another front, Binance’s U.S. arm must wait to close its $1 billion deal for Voyager Digital’s assets until the Department of Justice…

Voyager Digital Sells Assets via Coinbase Amid Bankruptcy

Voyager Digital, the New York-based centralized finance (CeFi) platform, filed for Chapter 11 bankruptcy in July 2022 after it failed to secure a new line of credit. The company, which provides cryptocurrency trading services for retail and institutional investors, had been struggling with mounting debt and declining user growth. Since then, Voyager has been seeking ways to raise capital and pay off its creditors. According to recent reports, the company has turned to Coinbase, one of the largest cryptocurrency exchanges in the world, to sell off some of its assets…

Unpacking India’s CBDC Pilots as Country Prepares for Digital Rupee

India launched two CBDC pilots last year. The first, a wholesale CBDC effort (CBDC-W), began on Nov. 1 with the participation of nine banks. The other, a retail CBDC (CBDC-R) pilot, launched on Dec. 1 in four cities – Mumbai, New Delhi, Bengaluru and Bhubaneswar. Initially, four banks, including the State Bank of India, ICICI Bank, Yes Bank and IDFC First Bank participated. Author: Source link

California DMV taps Tezos blockchain for digital car title transfers

The California Department of Motor Vehicles (DMV) is trying to digitise car titles and title transfers on a private Tezos-built blockchain. The state agency has collaborated with Tezos and blockchain software firm Oxhead Alpha to build a successful proof-of-concept. The move is part of a wider push to modernise the state’s in-place systems for car titles and increase transparency in title transfers. California’s DMV is responsible for all vehicle registrations and driver’s licences in the state. Oxhead Alpha has built a Tezos testnet designed as a blockchain-based replica of the…

Bank of England governor questions need for digital pound

Andrew Bailey, the Bank of England (BoE) governor, expressed skepticism on the need for a digital pound shortly after finance ministers from eurozone countries backed further work on a digital euro. The BoE governor recently questioned the need for a wholesale central bank digital currency (CBDC), citing that there already is a “wholesale central bank money settlement system with a major upgrade.” In addition, Bailey also expressed that there are no plans to abolish cash regarding retail use. The BoE governor does not believe that retail payments need to change…

Digital Currency Group under investigation by U.S. authorities: Report

Crypto conglomerate Digital Currency Group, or DCG, are under investigation by the United States Department of Justice’s Eastern District of New York (EDNY) and the Securities and Exchange Commission (SEC), according to a Bloomberg report. The authorities are digging into internal transfers between DCG and its subsidiary crypto lending firm Genesis Global Capital, noted the report citing people familiar with the matter. Prosecutors have already requested interviews and documents from both the companies, while the SEC is running an early-stage similar inquiry. As of yet, no indictment has been brought…