TL;DR: Coinbase is announcing its partnership and investment in the WNBA ecosystem. Today, Coinbase is excited to announce our expanded investment within the Women’s National Basketball Association (WNBA) ecosystem. In addition to the League, our new partners include the Women’s National Basketball Players Association (“WNBPA” — the union which represents all players), two team partners, the New York Liberty and Seattle Storm, and two of the league’s biggest stars, Sue Bird and Jewell Loyd. Coinbase believes the cryptoeconomy will be built by talented and creative women who are rewriting the…

Tag: Investing

Dream11’s parent marks its foray into Web3 by investing in cricket NFTs startup Rario

Rario has raised $120 million in a round led by Dream Capital. This strategic alliance will give Rario access to the 140 million user base of Dream Sports. Rario claims to have sold over 50,000 NFTs to sports fans across 20 countries. Dream Capital — the investment and mergers and acquisitions (M&A) arm of Dream Sports — has taken its first step towards the Web 3.0 space with investment in a cricket non-fungible tokens (NFTs) platform Rario. Rario has raised $120 million in a round led by Dream Capital. This…

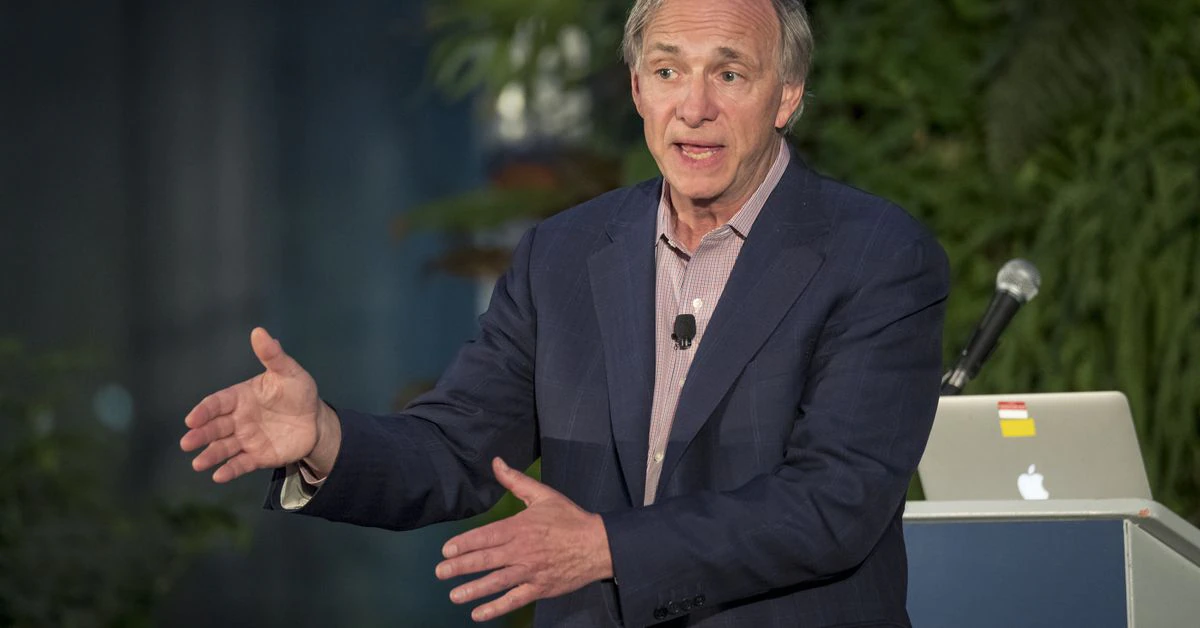

Ray Dalio’s Bridgewater Investing in Crypto Fund: Sources

It’s the first signal to date that the world’s largest hedge fund is taking crypto seriously with its own money. Author: Danny Nelson, Ian Allison Source link

Singapore VC Lightbulb Capital Balances the 3 Parts of ESG Investing. Will the DeFi World Care?; Bitcoin, Ether Fall

“We don’t take this decision lightly. Mastercard has operated in Russia for more than 25 years. We have nearly 200 colleagues there who make this company so critical to many stakeholders. As we take these steps, we will continue to focus on their safety and well-being, including continuing to provide pay and benefits. When it is appropriate, and if it is permissible under the law, we will use their passion and creativity to work to restore operations.” (Mastercard statement on suspension of services in Russia) … “We are compelled to…

A16z Investing $70M in Ethereum Staking Provider Lido Finance

Venture capital firm Andreessen Horowitz (a16z) has invested $70 million in Lido Finance, a liquid staking provider that makes it easier to stake ether and other proof-of-stake (PoS) assets. The firm also used Lido to stake an undisclosed portion of a16z Crypto’s ether holdings on the Beacon Chain. Author: Brandy Betz Source link

CryptoLeague Raises an Oversubscribed Pre-Seed Round of $2.2M, Pioneering the Power of Web3 Investing Communities

Waitlist Sign-Up Now Available for the Next Generation of Web3 Investors. MIAMI, March 2, 2022 /PRNewswire/ — CryptoLeague, a Wynwood-based web3 tech company, announced today that it closed an oversubscribed pre-seed round, unlocking its mission to empower web3 investing communities with the tools to accelerate their financial freedom. The $2.2M round, with participation from Gaingels, Great Oaks Venture Capital, Magic Fund, Side Door Ventures, Darling Ventures, Boutique Capital, Florida Funders, and a group of web3-focused super angels will be utilized to further develop the CryptoLeague product and continue assembling its…

NFTs and DeFi are revolutionizing real estate investing and homeownership — Here’s how

NFTs continue to make an impact on multiple sectors, and this mainstreaming is opening up new opportunities and revealing new trends for blockchain technology. Recently, the real estate sector has shown interest in blockchain technology because it opens up the potential for fractionalized ownership, cryptocurrency-backed mortgages and other unique ownership, financing and payment models. Here’s a look at a few real estate-oriented blockchain projects that are to integrate decentralized finance, cryptocurrency payments and nonfungible tokens (NFT) to the sector. Propy Propy is the largest real estate-focused protocol in the cryptocurrency…

Hong Kong Regulators Impose Limits on Investing in Spot Crypto ETFs

“In the case of virtual asset futures contracts traded on a specified exchange which is a regulated futures market, trading is governed by conventional rules. Pricing transparency and potential market manipulation may be less of a concern,” the circular said, adding that the same applies to futures ETFs. Author: Sandali Handagama Source link

Apple stock jumps after CEO reveals it’s investing in the Metaverse

Apple’s stock price jumped in after hours trading after CEO Tim Cook said during the company’s Q1 2022 earnings call that he sees considerable potential in the Metaverse space. When asked on Jan. 27 during the call about Apple’s opportunities within the Metaverse, Cook responded “we see a lot of potential in this space and are investing accordingly.” “We’re always exploring new and emerging technologies and I’ve spoken at length about how it’s very interesting to us right now.” The Metaverse is an interoperable virtual universe created in part by…

NFTs, Metaverse, Web3, and new realities of startup investing, with Founders Co-op’s Aviel Ginzburg

Founders’ Co-op General Partner Aviel Ginzburg. (Founders’ Co-op Photo) So much of what happens in the startup world comes from serendipitous moments, random interactions that lead to fresh insights and new collaborations. And so much of that has traditionally happened at events, meetups, coffee meetings, and other in-person gatherings. Two years into the pandemic and remote work, what are the implications? That’s our first topic on this episode of the GeekWire Podcast with entrepreneur, software engineer and investor Aviel Ginzburg, general partner at Seattle-based seed-stage venture fund Founders Co-op. The…