The Fed tightening is a major risk, particularly for currencies of EMs running current account deficits. The deficit occurs when a country sends more money abroad than it receives, leaving the domestic currency vulnerable to increased borrowing costs elsewhere. Thus, countries running current account deficits, such as Brazil, India and Pakistan, may see strong demand for bitcoin. Author: Omkar Godbole Source link

Author: Omkar Godbole

Bitcoin Resilient as Commodity Prices Inflate, Dollar Strength May Hurt

Bitcoin trades were steady as commodity prices rallied on Monday, hinting at higher inflation ahead. However, the resilience to the escalating Ukraine-Russia crisis may prove fleeting as demand for the U.S. dollar, the global reserve currency and one of the most liquid asset globally, is rising. Author: Omkar Godbole Source link

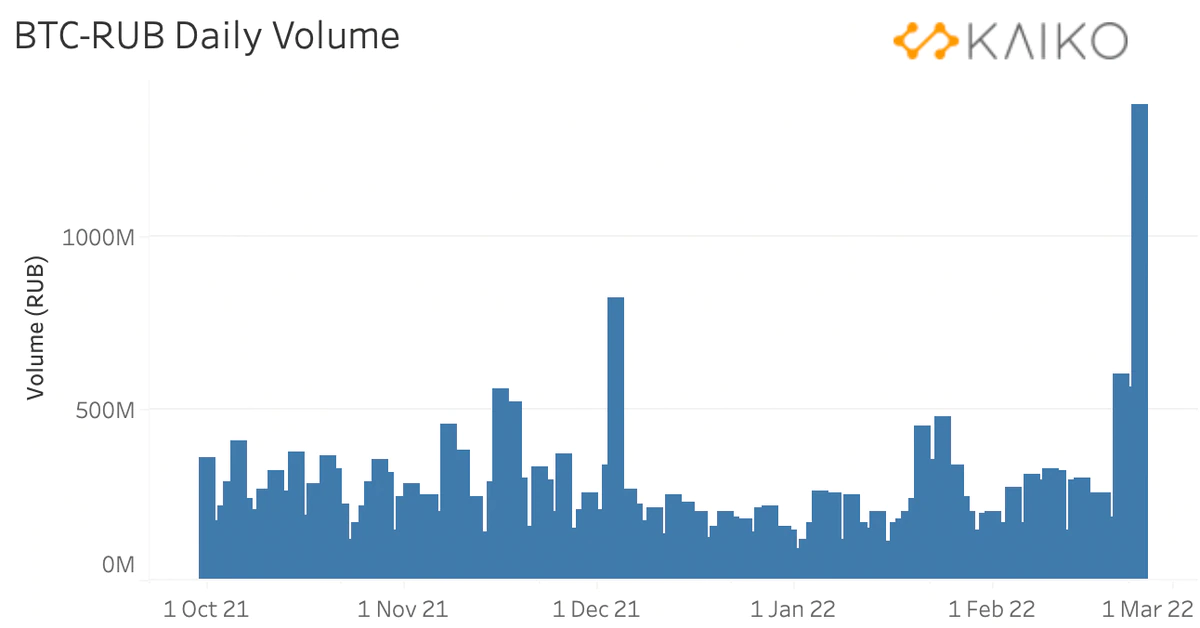

Ruble-Denominated Bitcoin Volume Surges to 9-Month High

Ruble-denominated crypto trading volumes rise as the West’s punitive sanctions on Russia trigger a flight away from Russia’s fiat currency. Author: Omkar Godbole Source link

Traders Prefer Gold, Fiat Safe Havens Over Bitcoin as Russia Goes to War

Dibb added that the combination of war, supply constraints, booming commodity prices and zero rates is a textbook recipe for stagflation. While the crypto community still strongly considers bitcoin as a better store of value, past data shows the cryptocurrency is predominantly a risk-on inflation hedge, meaning it outperforms other assets when investors are willing to take risks. Author: Omkar Godbole Source link

SAND Token, Below 200-Day MA, Joins Broader Crypto Market in Gloomy Outlook

Bitcoin, the top cryptocurrency by market value, dropped under the average in late December. A week later, ether, the second largest, and play-to-earn game Axie Infinity’s AXS coin followed suit. Heavyweights from other sub-sectors like UNI, LINK, XMR, AAVE, PERP and YFI also fell below their 200-day MAs early this year. Author: Omkar Godbole Source link

Bitcoin in Stasis Near $37K, Gold Extends Gains as Russia Starts Ukraine Invasion

In tense situations, investors prefer gold and oil than riskier assets like stocks and crypto. Author: Omkar Godbole Source link

Bitcoin Renaissance Likely in H2: Babel Finance

“After the market adjusts to the pace of the [Federal Reserve’s] rate hike, growth stocks and bitcoin will resume their upward trend, that is we will see a strong performance of both in the second half of 2022,” Robbie Liu, researcher at crypto financial services provider Babel Finance, told CoinDesk in an email. Author: Omkar Godbole Source link

Trader Joe's Native Coin Climbs as the DEX Unveils 'Modular Staking'

Modular staking allows users to price varied token utilities independently. Author: Omkar Godbole Source link

Bitcoin’s ‘MACD’ Indicator Threatens Long Term Bullish Bias as Rate Hike Fears Linger

“The correction is driven by macro factors, specifically expected rate increases and liquidity tightening from the U.S. Fed. The 60d correlation between BTC and the S&P 500 was virtually 0 at the end of 2017 – now, it is over 65%,” Noelle Acheson, head of market insights Genesis Global Trading, said in a LinkedIn post titled “Did You Say Crypto Winter.” Author: Omkar Godbole Source link

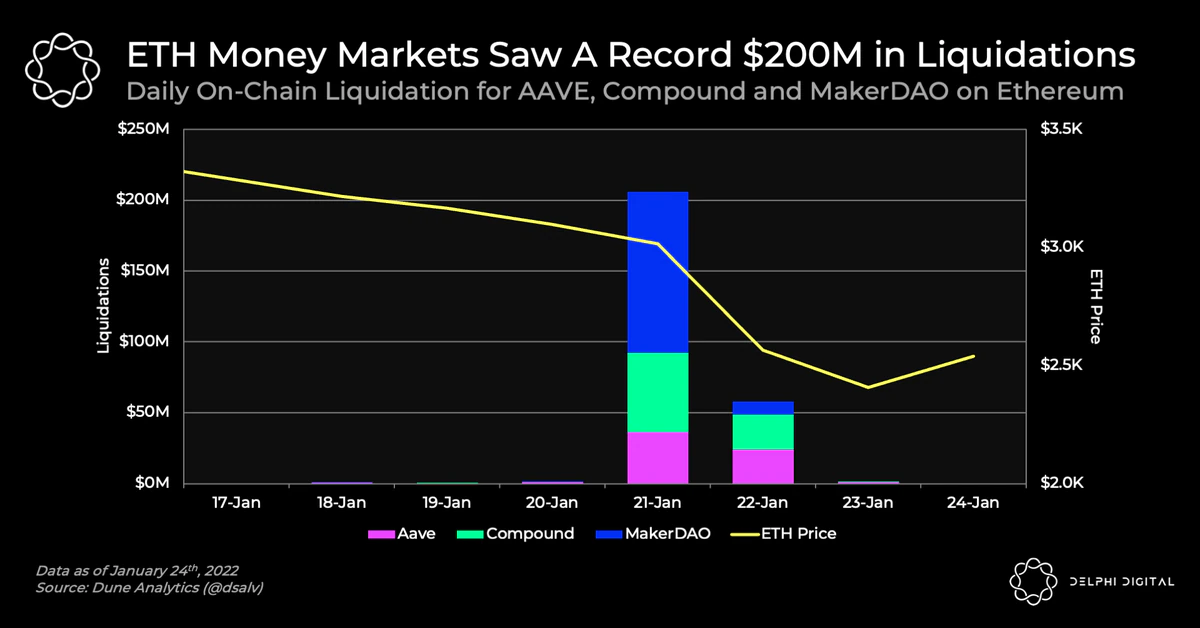

Ethereum Money Markets See Record Liquidations as Ether Tanks; MakerDAO Revenue Surges

“As a major correction sent ETH falling from $3,200 to $2,500 in the past week, on-chain liquidations surged as positions started to hit their liquidation point,” analysts at Delphi Digital said in Monday’s newsletter, adding that MakerDAO has profited from the liquidation event. Author: Omkar Godbole Source link